A New Chapter Begins

The transition into retirement is a crucial stage, as it marks the shift from an active working life to a period of freedom, along with new responsibilities. It is a time when careful planning is essential to ensure that financial resources, lifestyle choices, and personal goals are aligned with your long-term aspirations.

Did you know...?

According to a CIBC survey:

90% of Canadians who are not retired or semi-retired have not established an official and detailed plan outlining the lifestyle they wish to maintain in retirement.

53% of Canadians are unsure whether they are saving enough.

37% of Canadians are unable to save or have not given thought to retirement.

Annuities

An annuity is a retirement income product that guarantees regular and stable payments in exchange for an initial lump sum. You can choose an annuity that provides payments for a predetermined period (term-certain annuity) or an annuity that provides payments for life, with a guarantee until death (life annuity).

A term-certain annuity guarantees a minimum income over a defined period, offering a way to spread your retirement savings over a set timeframe without having to manage investments.

The annuity payment amount is guaranteed and determined in advance, taking into account factors such as the initial capital, prevailing interest rates, and the duration of the annuity.

If the funds used to purchase the annuity come from an RRIF or an RRSP, the annuity must provide income at least until age 90.

Payments are made for the full duration of the contract, and if you pass away before the end of the term, your beneficiaries will continue to receive the payments until the contract expires. Once the annuity period ends, payments stop and the contract terminates.

By choosing a life annuity, you gain peace of mind by securing a fixed income for life, without having to worry about managing investments.

Payments continue until your death, unless death occurs before the end of the guaranteed period selected. In that case, your beneficiaries will continue to receive payments until the end of the guaranteed period.

Also known as a joint annuity, this type of life annuity guarantees a fixed income for life for you and your spouse. You will receive fixed payments for the duration of your lifetime.

If you pass away before your partner, we will continue to pay them either the full annuity amount or a percentage of it, depending on the option chosen, for the remainder of their lifetime.

Payments begin shortly after the annuity is purchased, typically within the following year. It is often used to generate income quickly—such as at retirement—by converting a lump sum directly into regular payments.

Payments begin at a future date, sometimes several years after the annuity is purchased. This type of annuity allows savings to grow before income payments start. It is often used in long-term retirement planning, when income is intended to begin later, such as at an older age.

LIF

Life Income Fund

A LIF is a registered fund that allows you to extend the benefits of your locked-in retirement account (LIRA) or your employer-sponsored pension plan. Funds transferred into a LIF benefit from tax deferral and can be withdrawn to generate retirement income.

A LIF is similar to a RRIF, with one key difference: you cannot withdraw more than the maximum amount permitted each year.

You must transfer the funds from your LIRA to a LIF no later than December 31 of the year in which you turn 71.

LIRA

Locked-In Retirement Account

A LIRA is an account designed to hold funds transferred from a former employer’s pension plan into an individual, tax-sheltered retirement vehicle. Generally, contributions are not permitted, and withdrawals are not allowed until retirement age.

You may hold a LIRA until December 31 of the year in which you turn 71. After that, you must convert your LIRA into a LIF.

Upon your death, your LIRA is automatically transferred to your spouse.

RRIF

Registered Retirement Income Fund

A RRIF is designed to provide regular income in retirement. It allows individuals to transfer funds accumulated in an RRSP and convert them into regular payments, while continuing to benefit from tax-deferred growth.

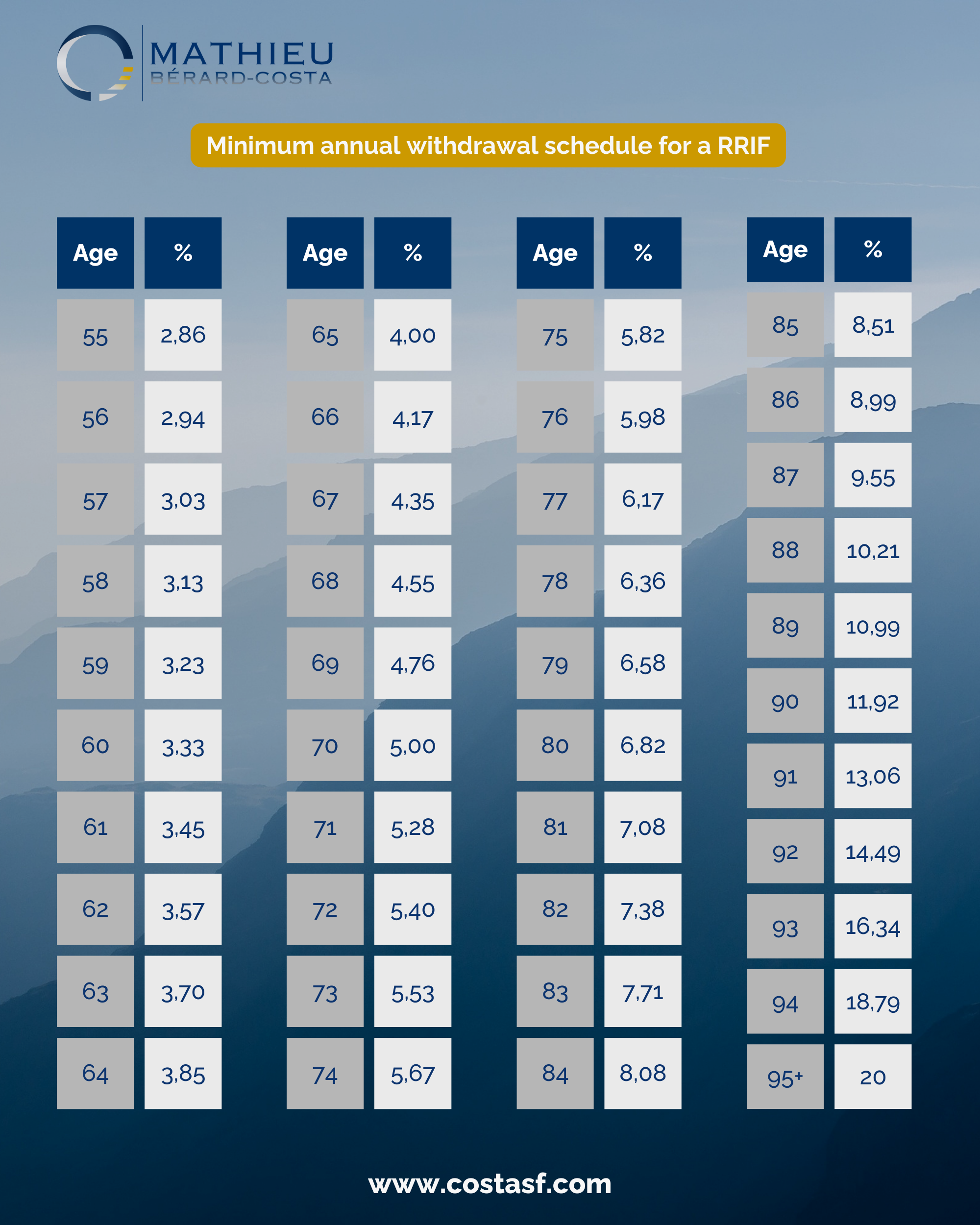

Withdrawals from a RRIF are taxed as ordinary income, and a minimum withdrawal amount is required each year—or monthly if preferred—but there is no maximum withdrawal limit, unlike a LIF. Additional contributions are not permitted once a RRIF has been established.

An RRSP must be converted into a RRIF no later than December 31 of the year in which you turn 71.

IPP

Individual Pension Plan

An IPP is designed specifically for self-employed individuals, business owners, and senior executives. This plan is funded by the company and established for your benefit. Employees who are related to you, including immediate family members, may also participate.

An IPP is a defined benefit plan, meaning the amount of your retirement pension is guaranteed and known in advance.

Savings are tax-sheltered.