The importance of mortgage insurance

Purchasing a property is one of the most important investments you will make in your lifetime. It is therefore essential to protect it in the event of death, disability, or a critical illness

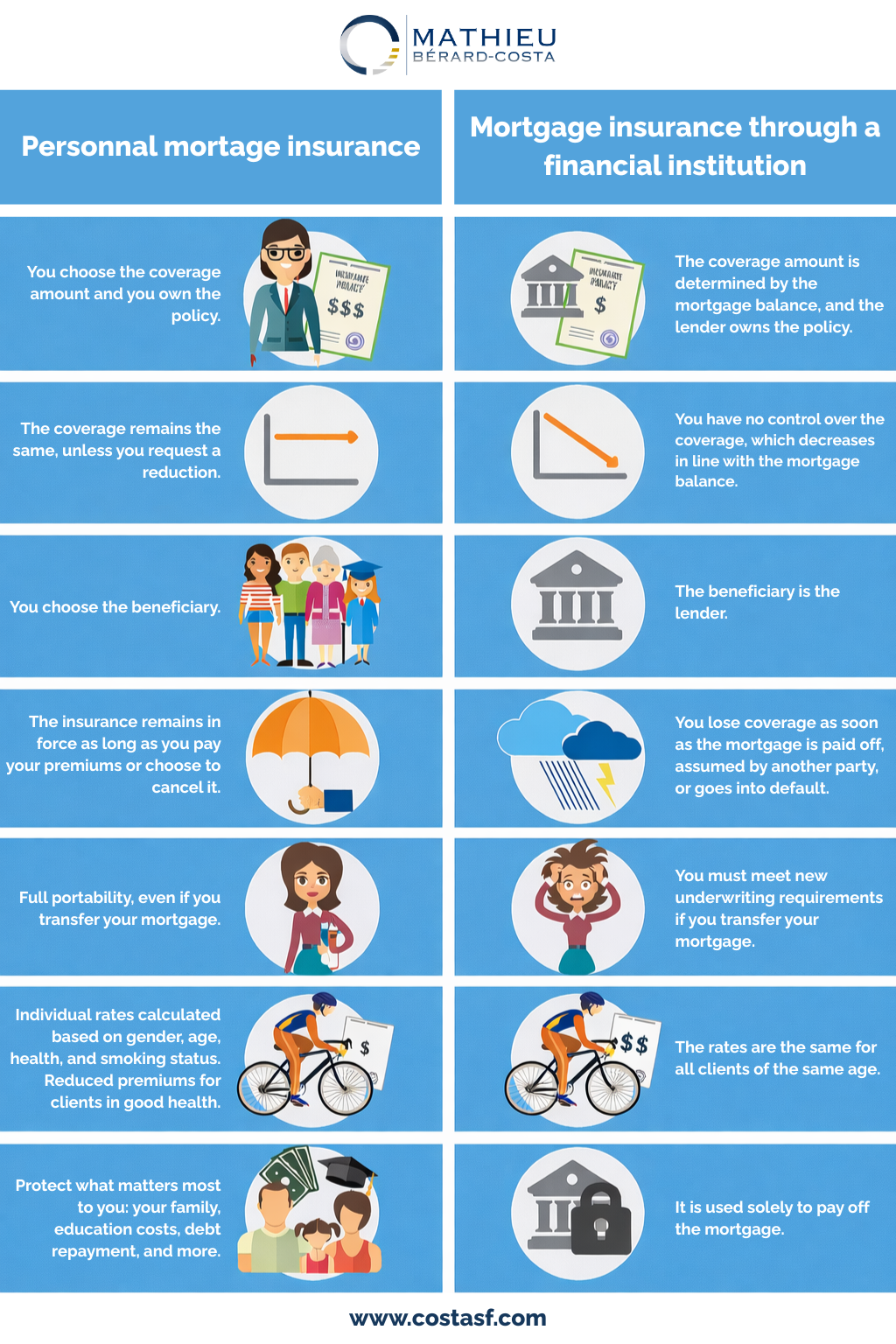

There are several advantages to purchasing coverage through insurance companies that financial institutions do not offer:

- You are the policy owner, which gives you greater control. You choose the beneficiary, who will receive the insurance benefit directly in the event of a claim.

- You can tailor the coverage to your needs (amount, term, and additional options such as disability or critical illness coverage).

- Premiums are set at the time of purchase and do not change as long as the policy remains in force, providing predictable costs.

Did you know...?

– Taking out mortgage insurance through a bank is more expensive than purchasing it through an insurance company.

– You can keep your mortgage insurance even if you change lenders at renewal.